What are you looking for?

-

Where can I find the Settlement report?

-

Transactions

-

Settlement report dashboard layout

-

Table column descriptions

-

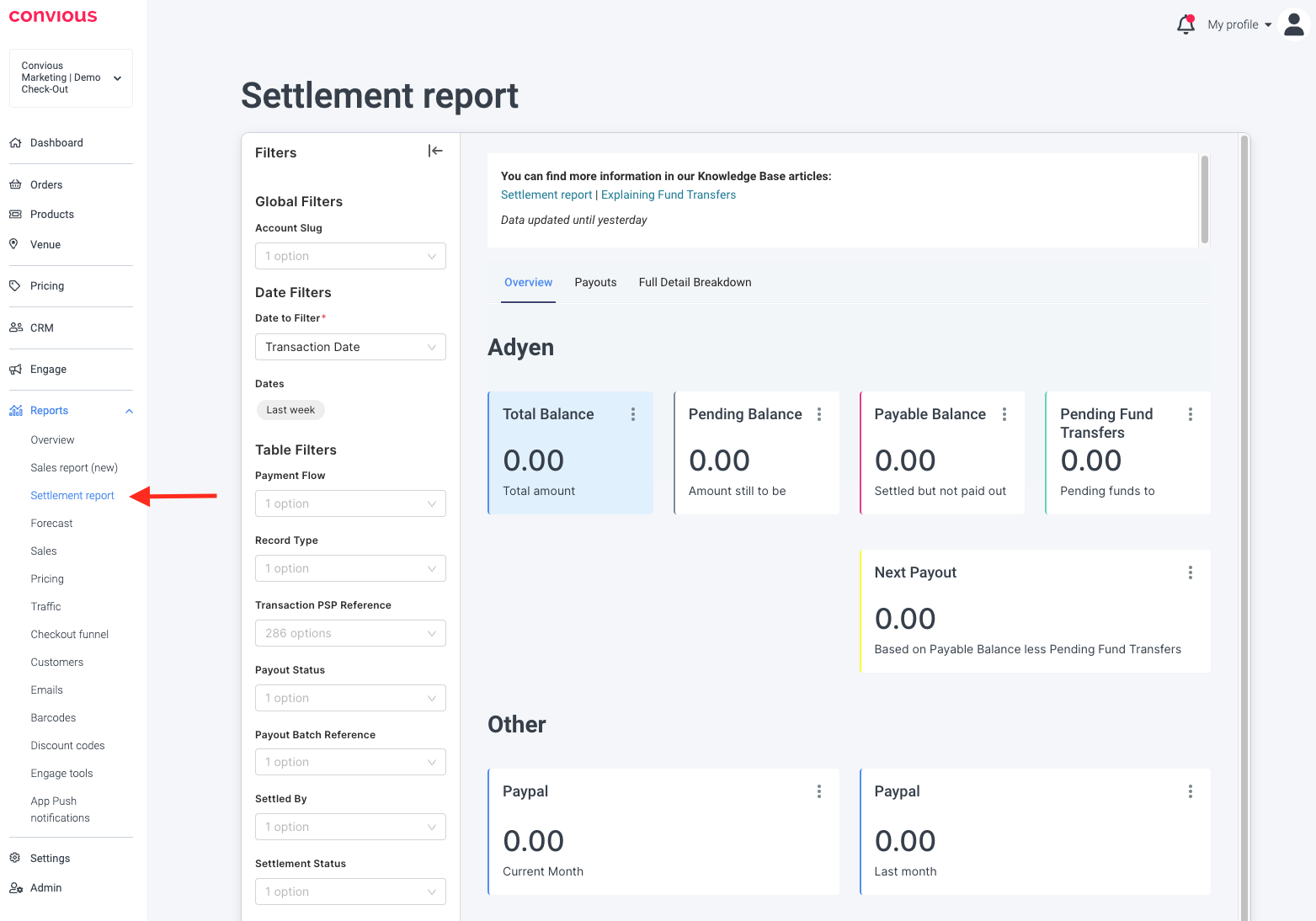

Filters of the report

-

FAQ

-

Webinar Recording

1. Where can I find the Settlement report?

The Settlement report can be found in your Control Panel under Reports.

2. Transactions

Adyen for Platforms

Your Adyen for Platforms account is configured to automatically send payouts 5 days a week to your bank account when there is a positive balance. By default, the payout schedule is set to daily (weekdays). Do you want to change this to a monthly schedule? Please get in contact with our Convious Support Team.

💡Keep in mind: A sale processed through Adyen has a payout delay of 2 business days by default. For example, with a payout delay of 2 business days and a daily payout frequency, sales that happened on Monday get assigned to the payout batch on Wednesday. On the weekend these are aggregated until after the weekend. This means on Sunday night there are no payouts. Payouts can take up to 5 working days to arrive in your bank account.

Once a payout is initiated, the 'payout status' will be set to paid, and a 'payout date' and 'payout batch #' will be provided.

Transactions done through Adyen are fully (100%) settled in your Adyen for Platforms account. All fees applicable to these transactions, both Convious fees as well as Payment Service Provider (PSP) fees, are calculated and settled through a fund transfer at the end of the month (more information below).

💡Keep in mind: Currently, there are two scenarios where the transactions are settled on the Convious Adyen Account instead of your Adyen Account. The two scenarios are either during a partial chargeback or a partial refund via POS. If applicable, these transactions will be corrected at the end of the month.

Your own PayPal Business account

PayPal deducts their payment fees immediately on their end; Convious is not involved in this.

Do you want to know more about Convious Invoicing? Have a look here!

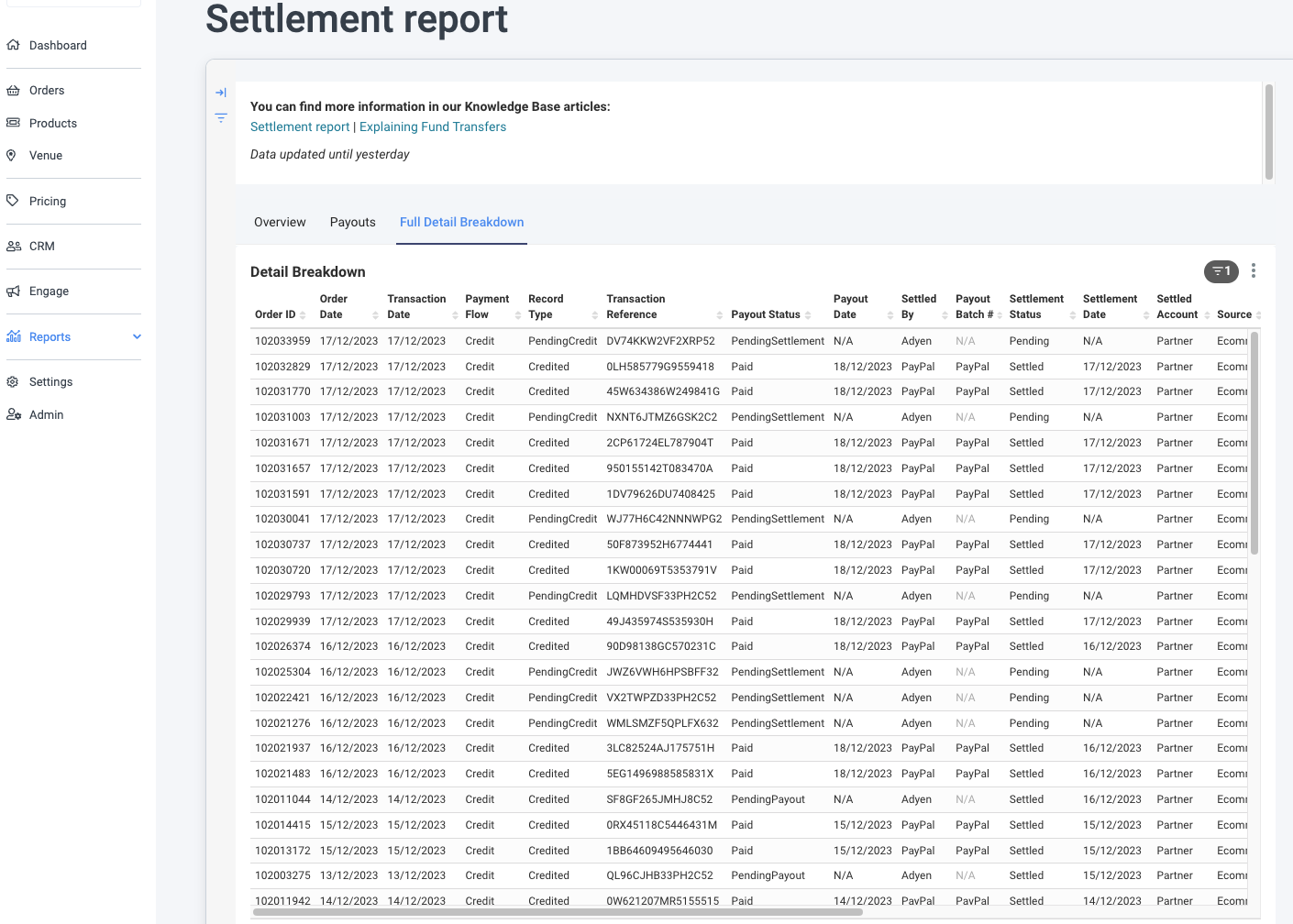

3. Settlement Report dashboard layout

The Settlement Report itself has three main pages each with different purposes:

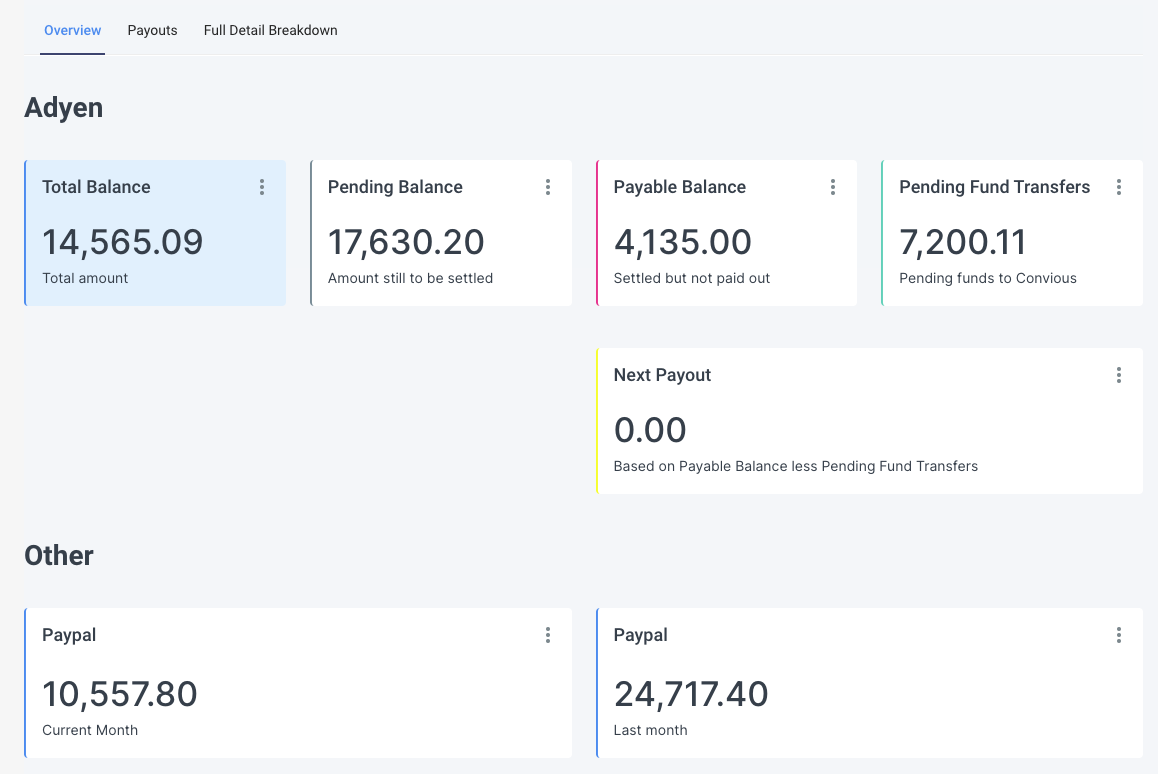

1. Overview Page

This page serves two main purposes. Firstly, it provides a set of metrics aimed at giving a high-level overview of the current settlement balances of all transactions. Secondly, it provides a detailed view of all transactions in their current state.

Metric Views:

- Adyen:

- Current Balance: Shows the current balance of all unpaid transactions. This metric is calculated with the formula "Pending Balance" + "Payable Balance" - "Pending Fund Transfers".

- Pending Balance: This shows the current balance of all transactions received by Adyen, but not yet settled for payment on their end.

- Payable Balance: This shows the current balance of all transactions settled for payment by Adyen, but not yet paid out.

- Pending Transfers: This shows the current balance of Fund Transfers, pending from the partner account to Convious

- Next Payout: The estimate for the next payout to the Partner Account. This is calculated with the formula "Payable Balance" - "Pending Transfers".

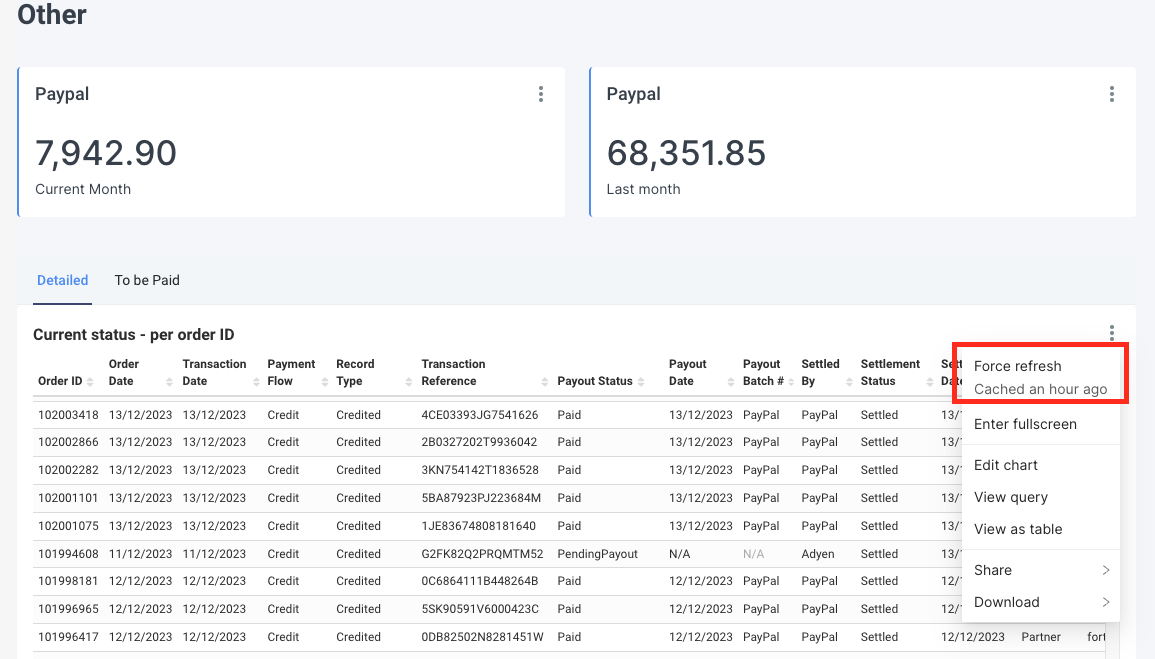

- Other

- Paypal - Current Month: Total value of all paid out PayPal transactions in the current month.

- Paypal - Last Month: Total value of all paid out PayPal transactions in the previous month.

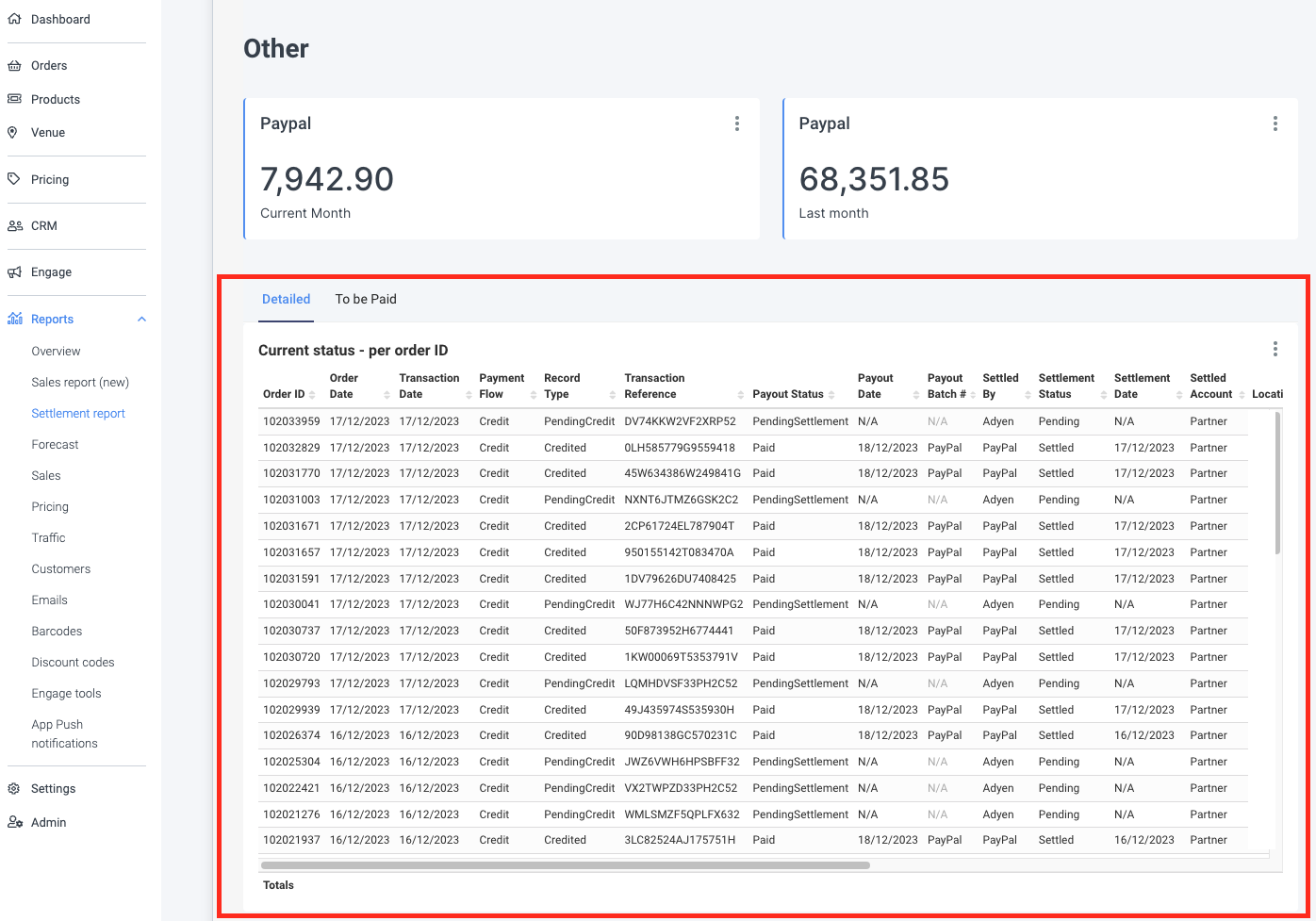

Current status - per order ID

- Detailed Table: This shows a detailed breakdown of all transactions in their current state, including dates, amounts, and statuses.

- To be Paid Table: This shows a slice of the detailed table, showing only transactions that are pending for payout to the partner.

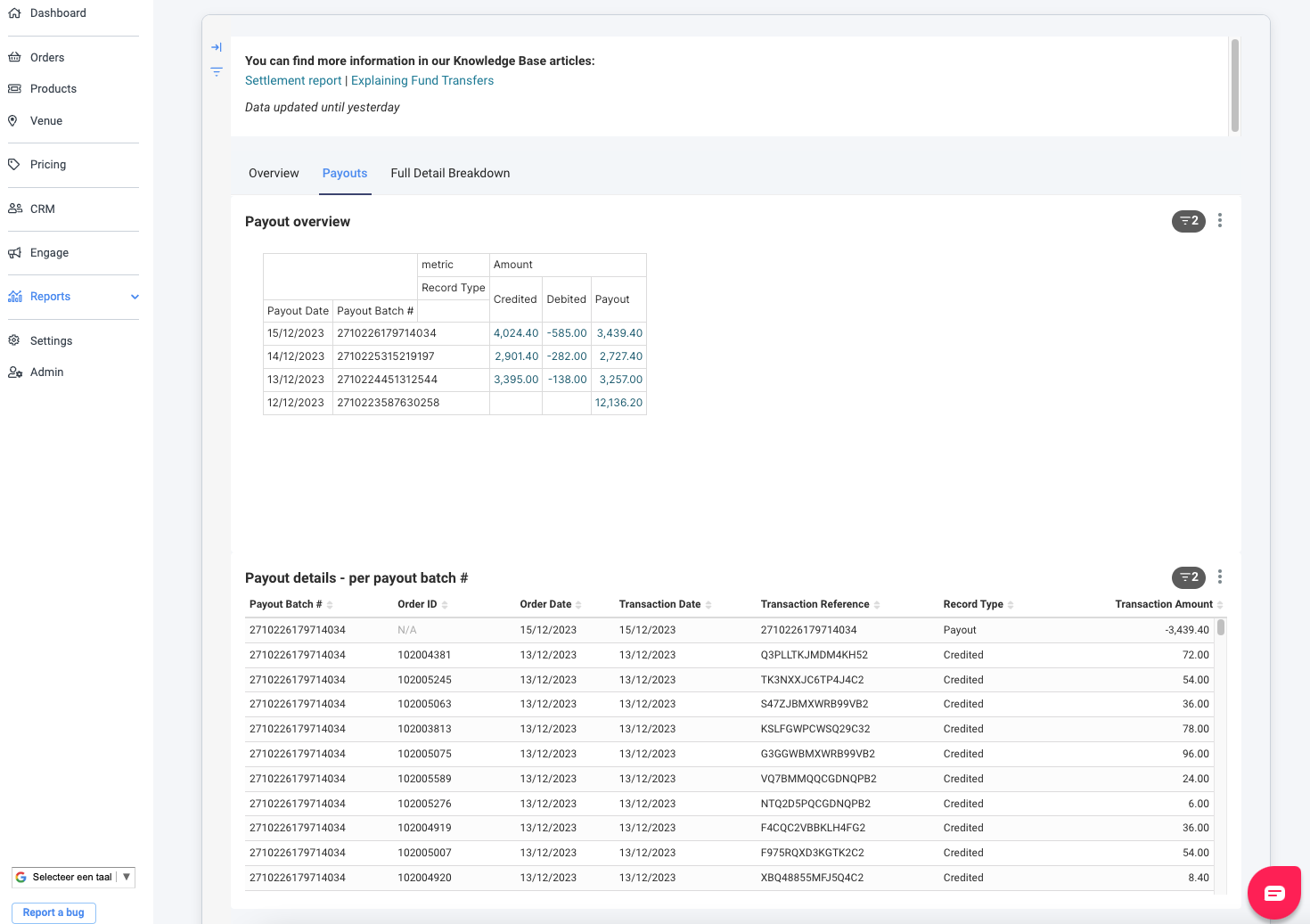

2. Payout Page

The purpose of this page is to provide both an aggregated and detailed view of the payouts that each partner received. Is provides information around the various lump sums that got paid out to partner bank accounts, as well as a reconciliation of what transactions were actually included in these payouts.

This page contains two mains charts:

- Payout Overview

- This is an overview of payouts as a whole, and provides information on amounts, dates, references, as well the various amounts that were attributed to each record type.

- Payout Details - per payout batch #

- This table can be used to provide a breakdown of each individual transactions that was attributed to a given payout.

3. Historical Page

This page provides a historical recount of each transaction, including when it was received, settled, paid as well as refunded if applicable. This is in contrast to the overview tables, which only show the most recent statuses of each transaction.

4. Table column descriptions

- Name: Order ID

Description: Identifier for an individual order

Possible Values:

- <ORDER ID>: ID for the order

- "Direct via POS": Certain POS transactions are not captured by Convious systems, and in that case it will show as this.

- "ID missing in BO": Very occasionally there are system discrepancies between the PSP and Convious databases. This means that we are unable to locate the order ID and this will be shown as this.

- NULL: Shown for rows that are not associated with an order e.g. Fund Transfers or Payouts.

- Name: Order Date

Description: Date that the underlying order was placed. Will be the same for rows with the same Order ID.

Possible Values:

- <ORDER DATE>: Date for the order

- Name: Transaction Date

Description: Date of the financial transaction (e.g. payment/refund).

Possible Values:

- <TRANSACTION DATE>: The date on which the financial transaction occurred.

- Name: Payment Flow

Description: States the direction of the money flow.

Possible Values:

- Credit: Inflow to PSP account (e.g. payment)

- Debit: Outflow from PSP account (e.g. refund)

- Payout: Transfer of money from PSP account to partner bank account

- Name: Record Type

Description: The event record type of the current row

Possible Values:

- Credited, Debited, Chargeback, FundTransfer, Payout, PendingCredit, PendingDebit, ...

- Name: Transaction Reference

Description: PSP reference associated with the order

Possible Values:

- <PSP REFERENCE>: The PSP reference of the order

- Name: Payout Status

Description: The payout status of the associated transaction. This tracks if the money has been paid to the partner account yet.

Possible Values:- Paid: The money has been settled and paid to the partners bank account.

- PendingPayout: The money has been settled, but not yet paid out to the partners bank account.

- PendingSettlement: The money has not yet been settled by the PSP, and will not yet be paid to the partners bank account.

- PaidToConvious: The money was paid directly to the Convious account instead of the partner account.

- Name: Payout Date

Description: The date the money was transferred from the PSP account to the partners bank account.

Possible Values:

- <PAYOUT DATE>: The date the money was transferred

- N/A: This is shown when the transaction has not yet been paid out.

- Name: Payout Batch #

Description: Batch reference number of the transfer from the PSP account to the partners bank account.

Possible Values:

- <PAYOUT BATCH #>: The batch number of the payout

- PayPal: This is shown for all PayPal transaction, as the money is paid to the partner bank account directly and is not associated with a batch.

- N/A: This is shown when the transactions has not yet been paid out.

- Name: Settled By

Description: Payment service provider (PSP) that settled that transaction

Possible Values:

- Adyen, PayPal

- Name: Settlement Status

Description: Whether the PSP has processed and settled the received transaction.

Possible Values:

- Pending: Transaction has been received by the PSP, but not yet settled or paid out.

- Settled: Transaction has been settled by the PSP and is now ready to be paid out.

- Name: Settlement Date

Description: Date of the individual record event (e.g. payment/refund) for an order.

Possible Values:

- <SETTLEMENT DATE>: The date of the individual record associated with an order.

- Name: Settled Account

Description: Which account the transaction was settled in.

Possible Values:

- Partner: Directly to the partners PSP account

- Convious: Transaction was paid to the Convious PSP account first. Will be settled to the partner at a later date.

- Name: Source

Description: Where the transaction originated from.

Possible Values:

- POS: A point of sale transaction

- Ecommerce: A transaction made through our Ecommerce platform

- Name: Location

Description: Grouping location of the order. Only relevant for partners with multiple locations.

Possible Values:

- <LOCATION>: Location ID of the transaction

- Location Not Found: This will show when we can not locate the exact place of transaction, or if the transaction cannot be associated with a location i.e. transaction is a Fund Transfer.

- Name: Payment Method

Description: Payment method used by the customer for the payment.

Possible Values:

- e.g. PayPal, ApplePay, MasterCard.

- Name: Transaction Currency

Description: The currency the transaction/payment was made in.

Possible Values:

- e.g. EUR, GBP, ...

- Name: Transaction Amount

Description: Total value of the transaction (in the transaction currency).

Possible Values:

- <TRANSACTION AMOUNT>: Amount of the transaction.

- Name: Pending Amount

Description: Amount received by the PSP but still to be settled and paid out.

Possible Values:

- <PENDING AMOUNT>: Amount currently pending.

- Name: Payable Amount

Description: Amount received and settled by the PSP, and eligible to be paid out to the partner bank account.

Possible Values:

- <PAYABLE AMOUNT>: Amount that is payable to the partner.

- Name: Paid Amount

Description: Amount actually paid to the partner bank account. The total outstanding payable amount will equal "Payable Amount" - "Paid Amount".

Possible Values:

- <PAID AMOUNT>: Amount paid to the partner.

5. Filters of the report

- Filter Date: You can filter on either Booking Date, Order Date, or Payout Date

- Date Range: You can select a specific date range.

- Payment Flow: You can select Credit, Debit or Payout

- Record Type: You can select Pending Credit, Pending debit, Credited, Debited, Payout, Fund Transfer, and various Chargeback statuses

- Transaction PSP reference: Here you can see the Payment Service Provider reference number

- Payout status: You can select Paid, PaidToConvious and PendingSettlement

- Payout Batch Reference: You can select the batch reference number of the transfer from the PSP account to the partners bank account

- Settled By: You can filter on Adyen and Paypal

- Settlement status: You can filter on Settled and Pending

- Settled account: You can filter on Partner or Convious

- Order source: You can filter on Ecommerce or POS

- Location: You can filter on location (only relevant for partners with multiple locations)

- Payment Method: You can filter on the payment method

Additionally, you have the option to refresh your Settlement Report, change the view, download, export, or share it. Click on the three dots in the upper right corner of the Filter or Table and select one of the options.

💡Keep in mind: To speed up loading times, the data is stored in a cache. If you want to see the latest information, click the three dots in the upper right corner and choose "force refresh".

💡Good to know: A cache is a software component that stores data temporarily to make future requests for that data faster.

6. FAQ

Do you have any more questions about the Sales Report (new) or how Convious handles invoicing?

Have a look at our FAQ!

7. Webinar Recording

Webinar host: Steven Egger, Product Manager

Date: 30th of January 2024

Topics:

- Learn how to easily navigate your upgraded Settlement Report

- Get a grasp of the transactions available in this improved reporting

- Answers to your specific questions during a dedicated Q&A session